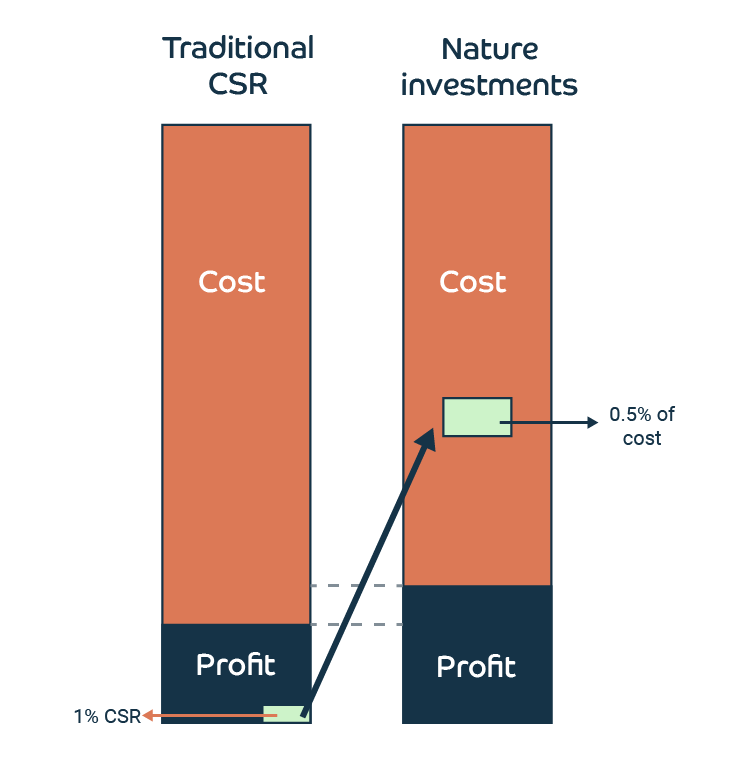

Traditionally, businesses have often approached philanthropy as a marketing tool, using corporate social responsibility (CSR) to highlight their commitment to ethical and environmental causes. CSR initiatives typically allocate a small portion of profits to projects that benefit the community or the environment, gaining good publicity in the process. In some cases, CSR has even helped businesses test new products or attract new customers.

While well-run CSR programs do aim to make businesses more ethical and environmentally responsible, initiatives to support nature should not be relegated to CSR alone.

After all, in today’s business landscape, companies face dramatic environmental challenges that directly affect their long-term viability. In an era of escalating environmental crises, the relationship between nature and business sustainability has shifted dramatically.

Investments in nature should therefore not be treated as philanthropy. Instead, such investments should be treated as core operational costs necessary for a company’s survival, risk management, and profitability. It’s an essential cost of doing business.

Businesses across industries—from agriculture and fisheries to construction and tourism—are heavily dependent on nature. Forests, wetlands, oyster reefs, and other ecosystems provide clean air, fresh water, and resources that underpin the global economy. In fact, a recent study shows that over half of global GDP is at least moderately dependent on nature*.

By embedding nature-based solutions into core operational strategies, businesses can secure long-term access to these resources while mitigating risks associated with environmental degradation. What’s more, investments in nature offer financial returns through cost savings and increased resilience to climate-related risks.

The financial benefits of nature-based solutions are tangible. Mangroves or oyster reefs can protect coastal infrastructure by absorbing storm surges and combatting coastal erosion, saving billions in disaster recovery costs. If these investments are reduced to a CSR activity or are only made to comply with regulation, businesses risk missing out on the substantial financial returns that can be realised by integrating ecosystem-based solutions into long-term planning.

Viewing nature investment through the lens of CSR or compliance means missing out on the significant financial opportunities that nature restoration can offer.

Just as businesses invest in maintaining machinery, infrastructure, or technology to remain competitive, so too should they invest in maintaining the ecosystems that support their supply chains and operations.

By treating nature investments as an integral part of the cost of doing business and recognising their implicit monetary benefits, it should become obvious to decision-makers and shareholders alike that allocating half a percentage of cost to targeted nature restoration by far outweighs donating a full percent of the bottom line to more general nature targets.

In the long run, more capital will then be unlocked to restore nature whilst businesses will enhance their competitive position. Nature restoration truly offers the elusive win-win

* An analysis PwC released in April 2023, found that 55% of global GDP, equivalent to an estimated $58 trillion, is moderately or highly dependent on nature

Make a measurable difference for the ocean today.

You can now adopt a Mother Reef and help restore 100 oysters!